how to pay indiana state taxes quarterly

We last updated the Estimated. The state of Arkansas charges 1 per month on taxes that are not paid by the deadline.

.png)

The Proper Role Of Congress In State Taxation Ensuring The Interstate Reach Of State Taxes Does Not Harm The National Economy Tax Foundation

Any employees will also need to pay state income tax.

. The tax bill is a penalty for not making proper estimated tax payments. Interest of 10 per year on any additional tax due from original due date to date. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

QuickBooks Self-Employed calculates federal estimated. SBAgovs Business Licenses and Permits Search Tool. Tax Payment Solution TPS - Register for EFT payments.

Withholding and tax credit will not be less than. The Indiana income tax rate is set to 323 percent. If you owe 1000 or more in state and county tax thats not covered by withholding taxes or if.

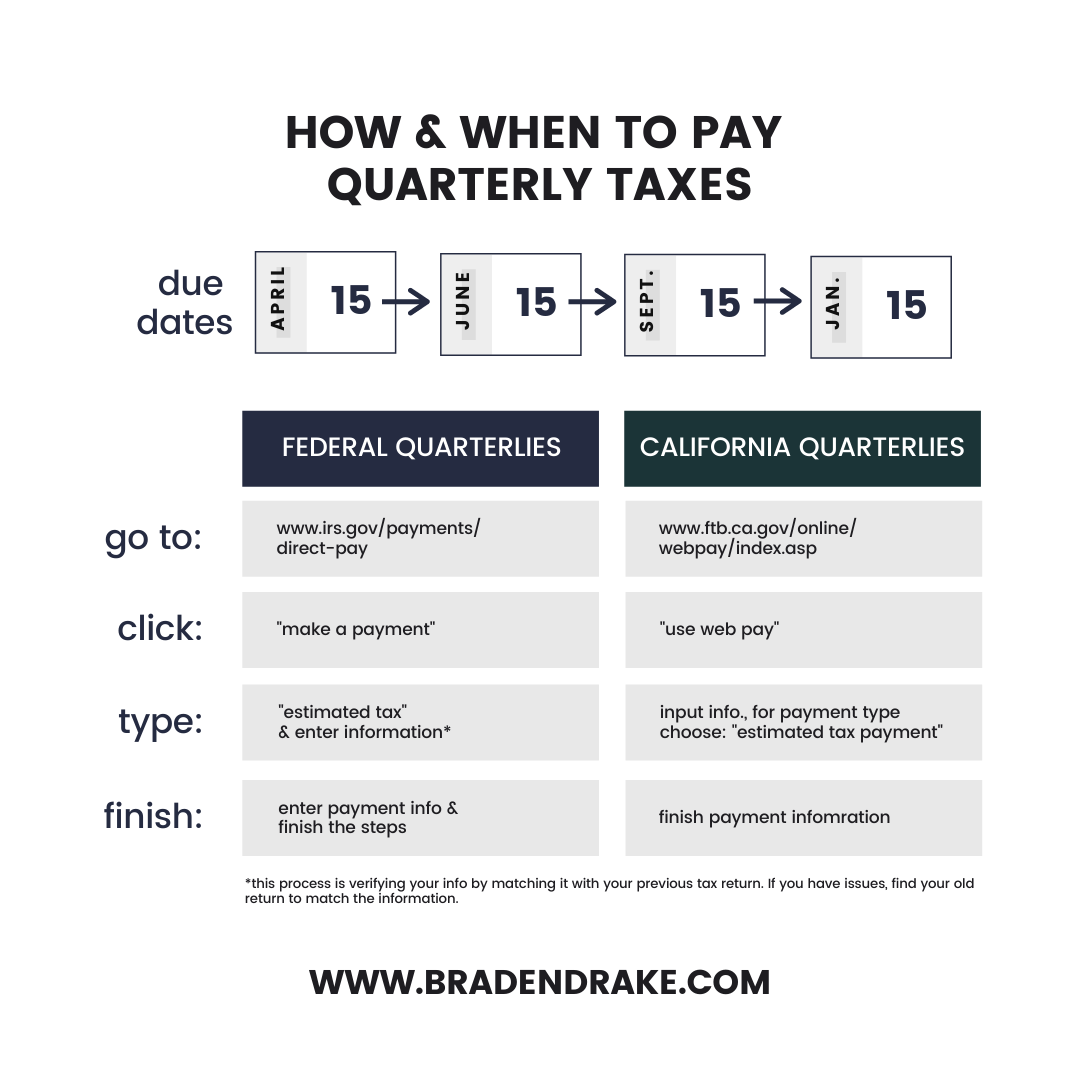

Under non-bill payments click your payment method of choice. To make a payment via INTIME. To pay an estimated payment or an extension payment for your Corporation Income Tax andor Limited Liability Entity Tax LLET.

Find Indiana tax forms. Enter this amount on line 4 Estimated Tax Installment Payment at the top of the form. Your tax projection exceeds 1000 after removing withholding and tax credits during tax return filing.

Indiana Small Business Development Center. Follow the instructions to make a payment. This means you may need to make two estimated tax payments each quarter.

DState D EZIP Code E FIndiana County F HTax Year Ending H Month Year. One to the IRS and one to your state. Use form ES-40 to pay Indiana state estimated quarterly taxes if applicable.

Be sure to denote that you are making an individual income. The estimated income tax payment and Form E-6 and IT-6 are due on April 20 June 20 Sept. Know when I will receive my tax refund.

Information about novel coronavirus COVID-19 INgov. Lines J K and L If you are paying only the. However some counties within Indiana have an additional tax rate making the.

Department of Administration - Procurement Division. 90 of the quarterly estimated tax for. Bank or credit card.

Access INTIME at intimedoringov In the top right corner click on New to INTIME. Line I This is your estimated tax installment payment. Sign up Once logged-in go to the Summary tab and locate.

Estimated payments may also be made online through Indianas INTIME website.

How To Pay Quarterly Income Tax 14 Steps With Pictures

Quarterly Tax Calculator Calculate Estimated Taxes

General Sales Taxes And Gross Receipts Taxes Urban Institute

A Complete Guide To Indiana Payroll Taxes

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Quarterly Tax Calculator Calculate Estimated Taxes

File 1941 Mid Year Tax Calendar For Indiana Dpla Dae89696f77e09c596eacc3c2f4a4be8 Page 2 Jpg Wikimedia Commons

Indiana Taxes For New Employees Asap Payroll Services

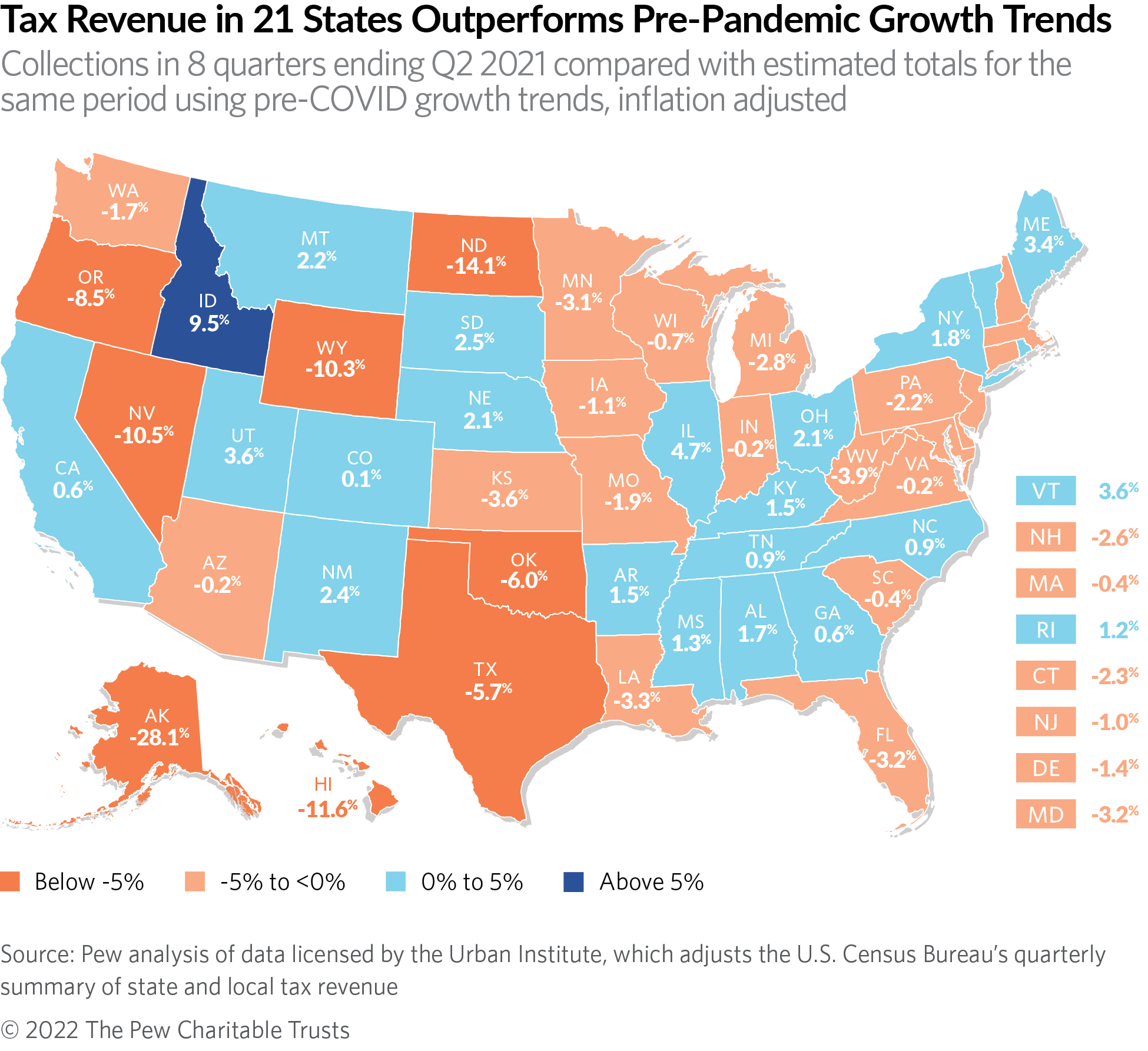

Tax Revenue In 21 States Outperformed Pre Pandemic Growth The Pew Charitable Trusts

Hoosiers Will See Mailed Tax Refund Checks As Early As Next Week Inside Indiana Business

Quarterly Tax Calculator Calculate Estimated Taxes

State Of Indiana Quarterly Premium Tax Form

Dor Keep An Eye Out For Estimated Tax Payments

The Complete J1 Student Guide To Tax In The Us

How To Calculate And Save Your Quarterly Taxes

Tax Season 2021 Quarterly Taxes Still Due April 15 For Most

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back